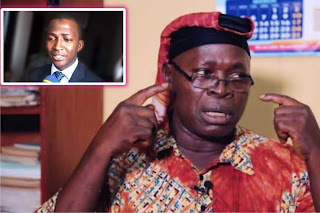

EFCC Interrogates Former Minister Sadiya Umar-Farouk Over Fraud Allegations

The Economic and Financial Crimes Commission (EFCC) conducted a lengthy interrogation on Monday with the former Minister of Social Development, Disaster Management, and Humanitarian Affairs, Sadiya Umar-Farouk, regarding accusations of fraud.

A reliable source within the EFCC confirmed to the News Agency of Nigeria (NAN) that the former minister willingly appeared at the commission's headquarters on Monday morning.

"The former minister upheld her commitment to attend the commission's invitation concerning the alleged misappropriation of a multibillion-naira social intervention fund during her tenure," stated the source.

The source indicated that Umar-Farouk might be allowed to return home initially and might be required to come back for further questioning on Tuesday.

"She might not be detained immediately; there is a possibility she will be allowed to go home, but it will be late, and she has been instructed to report again tomorrow (Tuesday) morning for additional interrogation," the source added.

The ongoing EFCC investigation focuses on the alleged laundering of a substantial N37.1 billion by officials of the ministry during Umar-Farouk's time as minister.

A week ago, the EFCC also questioned Mrs. Halima Shehu, the suspended National Coordinator, and Chief Executive Officer of the National Social Investment Programme Agency (NSIPA), which falls under the ministry's supervision.